Why Is Investing So Important?

Keeping cash in a checking or savings account may feel safe, but over time, that money can lose value due to inflation. While your account might earn a small amount of interest, it often doesn’t keep pace with rising costs. That means today’s dollars may not go as far in 10 or 20 years.

Investing aims to help you:

- Protect purchasing power against inflation

- Generate passive income

- Work toward long-term financial goals

- Diversify risk across different asset classes

- Benefit from the power of compound growth

At WealthClarity, investment management is a core part of what we do. We take your unique financial picture and build a strategy that works quietly in the background — growing with time, not stress.

Our Investment Management Process

Also known as portfolio management or wealth management, this service involves making informed, long-term decisions about where and how your money is invested. Here’s how we approach it:

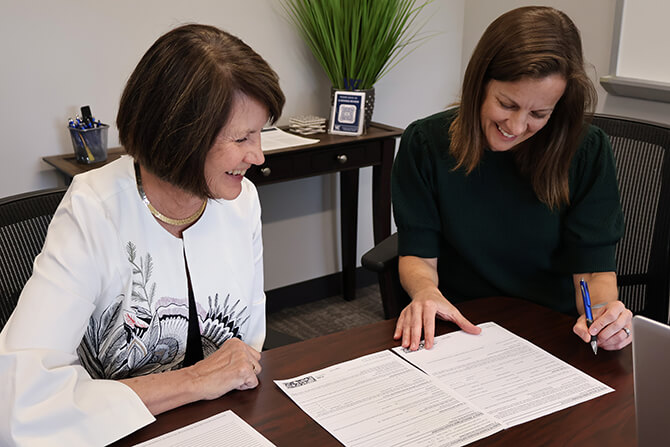

We Start With You

We take time to understand your goals, current financial situation, risk tolerance, and time horizon. This foundation allows us to build a plan that fits, not just today, but for years to come.

We Focus on Your Financial Future

Investing is like planting a tree — it needs time, patience, and the right environment to thrive. We prioritize consistent growth over time, rather than chasing short-term market wins.

Investing 101: How It All Works

If you’re new to investing or just want a refresher, here are a few key concepts we emphasize when building a portfolio:

The Value of Money

A dollar today is worth more than a dollar tomorrow. That’s why we prioritize strategies that put your money to work now.

Compound Interest Rates

When your investments earn interest, and that interest earns more interest, your wealth can grow exponentially over time. For example, a $100,000 investment earning 7% annually could grow to $107,000 in one year and $114,490 in two. Compounding rewards patience.

The Role of Time

The longer your money stays invested, the greater its growth potential. That’s why our investment philosophy focuses on discipline, consistency, and time-tested strategies.

Disclosure(s):This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

Our Commitment as Financial Advisors

As a wealth management services firm based in Lakewood, Colorado, we are committed to serving advisory clients in your best interest — always. That means:

- No commissions or product quotas

- No hidden agendas

- Just honest, realistic advice backed by deep industry knowledge

We hold advanced credentials and use that expertise to provide high-level guidance, no matter where you are on your financial journey.

Our Investment Philosophy

At WealthClarity, we’re committed to delivering thoughtful, personalized investment advice grounded in our fiduciary duty. Our approach centers on:

Client-Centered Planning

Every portfolio we build is unique, just like the people behind it. We consider your personal goals, risk tolerance, and timeline to create a plan tailored to you.

Education and Transparency

We don’t just manage your money — we help you understand where and why it’s invested. Our goal is to empower you with the clarity to make confident financial decisions.

Diversification and Risk Management

A well-diversified portfolio helps reduce exposure to market volatility. We spread investments across various asset classes, sectors, and geographies to help preserve your wealth and manage risk.

What We Invest In

Our clients benefit from diversified portfolios that may include:

- Exchange Traded Funds (ETFs)

- Mutual Funds

- Bond Exposure

- Professionally Managed Alternatives through LPL Financial

- In-House Asset Allocation Models

- Alternative Investments such as real estate exposure (without direct ownership

Every investment is carefully selected to match your objectives and long-term goals.

Investment Management as Part of a Bigger Plan for Your Financial Future

Investment management is available as a stand-alone service or as part of your broader financial plan. Whether you’re building wealth, preparing for retirement, or planning your legacy, our team is here to review, optimize, and guide your portfolio with care.

We serve clients across Colorado and the U.S., with both in-person and virtual meetings available.

Disclosure(s):There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Ready to Get Started?

If you’re ready to invest with clarity and confidence, we’d love to meet you. Schedule a complimentary consultation and let’s take the first step together.